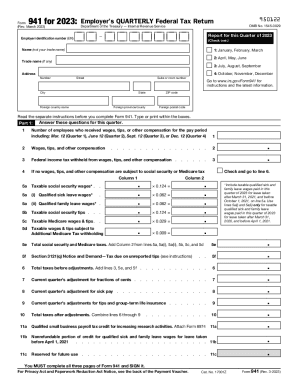

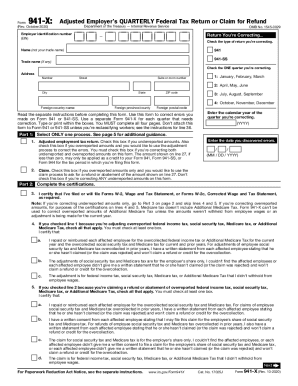

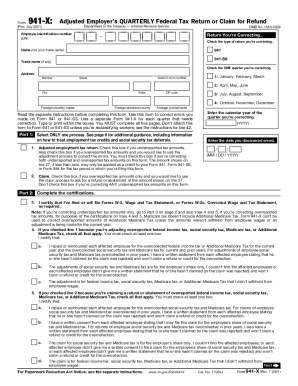

What is form 941-X?

The purpose of form 941 X is to report to the Internal Revenue Service about amendments to form 941 (Employer’s Quarterly Tax Return) or form 941-SS. For example, to inform the IRS about overreported or underreported tax amounts.

With the IRS form 941-X, you can amend:

- Wages, tips, and other compensation

- Tax withheld from wages, tips, and other compensation

- Taxable social security wages and tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding

Who should file form 941-X?

The IRS form 941-X is used to correct errors in the Employer’s Quarterly Tax Return on employee wages or claim a refund. This form can only be used by those who filed IRS forms 941 or 941-SS.

What information do you need when you file form 941-X?

The following information is required to fill out 941-X:

- Employer Identification Number

- Name

- Trade name (if any)

- Address

- The type of return you’re correcting

- The quarter and the calendar year of the correction

- The date you discovered errors

- The modifications you are willing to make

Please note, page 6 includes some additional instructions.

How do I fill out form 941-X in 2024?

It is essential to fill out a separate 941-X for each quarter you are willing to correct. When filling out the form, provide all information requested at the top of page 1. Check one box (not both) in Part 1. Check the box on line 3 and any applicable boxes on lines 4 and 5 in Part 2. Leave the lines that don’t apply blank in Part 3. Complete Parts 4 and 5 according to the form 941 X instructions.

Is form 941-X accompanied by other forms?

Taxpayers don’t need to attach other forms to the 941-X. However, they need to send proof of the changes with their return. For example, they are to provide a bank statement or other evidence of the new wage.

Those filing Employer’s Quarterly Tax Return with Schedule R must complete Schedule R (Form 941) to make corrections in the aggregate form 941.

If form 941 X is filed after the due date, send the form along with an amended Schedule B (form 941).

When is form 941-X due?

You can file 941-X within two years of the date you paid the tax reported on form 941 or within three years of the date when form 941 was filed. To correct underreported taxes, you must file 941-X within three years of the date form 941 was filed.

Where do I send form 941-X?

The completed and signed form is forwarded to the IRS by mail only. Find the correct mailing address for form 941 X on the IRS website.